After describing why Rubber futures can be a great market for traders , we will concentrate on iron ore today. This is one more essential item traded on the SGX in Singapore.

Iron ore is the key resources used in the manufacturing of steel. The SGX futures agreement is amongst the world’s most important benchmarks for iron ore offered the contract’s specs and Singapore’s distinct tactical location in the seaborne trade Remember that China make up regarding two-thirds of seaborne iron ore demand, and much of it undergoes the Strait of Malacca.

Unlike rubber, which is a smaller market, iron ore is substantial and much more liquid. That does not imply it’s immediately much better. Actually, I assume you’ll locate far better possibilities in rubber as a trader. Nonetheless, it would certainly be a good idea to at the very least see the rate activity in iron ore if you trade products generally, particularly metals.

Why larger markets are more vital

Did you recognize that adhering to iron ore rates can profit you exceptionally, even if you do not trade the iron ore futures themselves? I’m talking from my very own experience. While I don’t trade iron ore, I do trade metals like silver, copper, and platinum through ETFs and (seldom) miners.

What does iron ore relate to these different markets? Firstly, they are all steels and are correlated to each various other the majority of the time. And second, there is a certain hierarchy within the specific product groups. For example, silver is a tiny market compared to copper That indicates the price swings in silver can be relatively big as it does not take much money to relocate this tiny market in either direction.

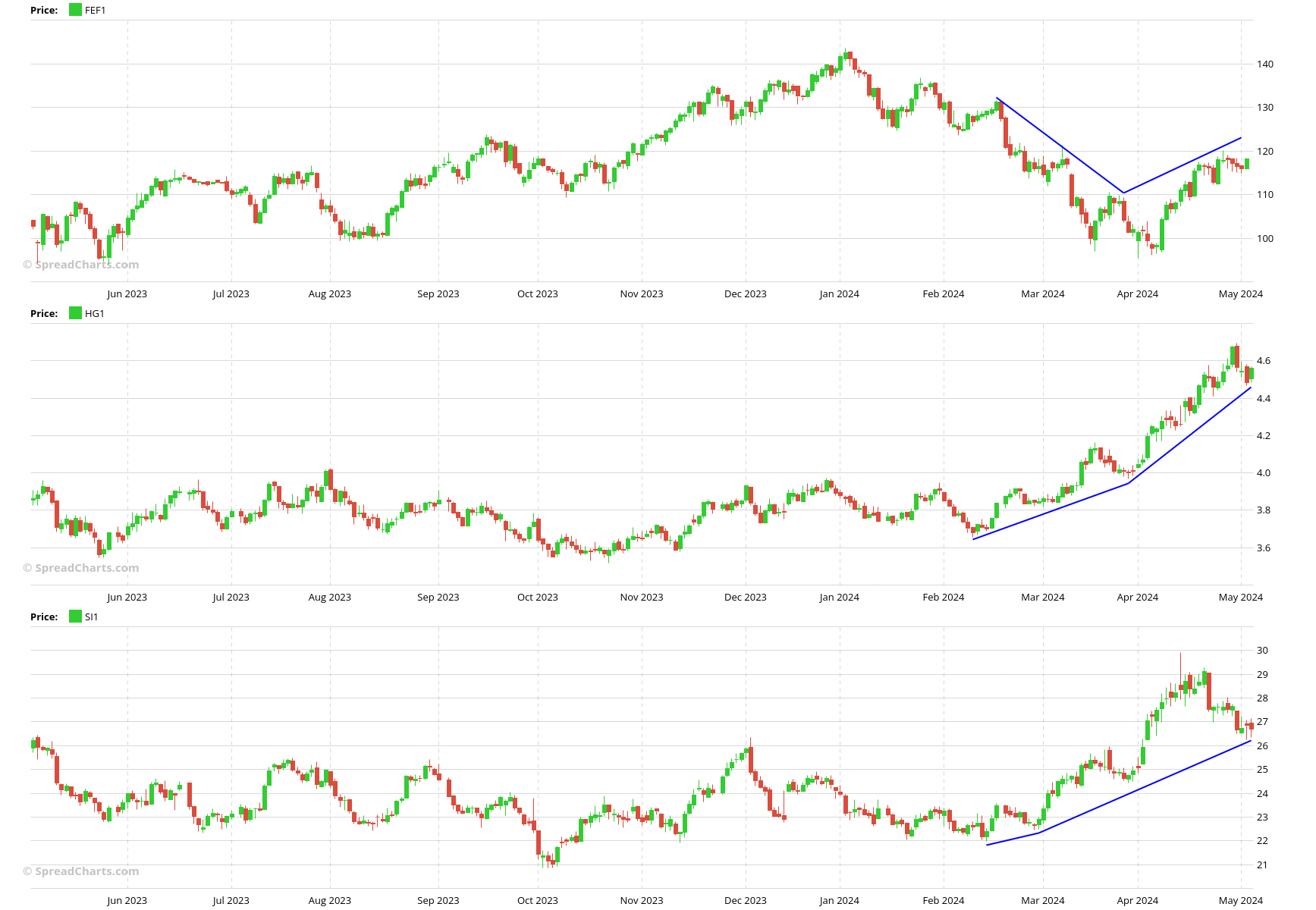

On the other hand, this sometimes leads to the silver cost getting out of touch with the reality in the physical market. That is specifically the reason you usually see us closely watching the copper market in our costs research study when making forecasts for silver. The copper market is a lot bigger and for that reason tougher to control. Yes, silver can lead sometimes. Yet most of the time, it’s copper that’s appropriate if both markets disagree Because in the long run, steel rates depend upon economic conditions. And if the economy is weak, it’s very not likely that a certain metal can defy gravity regardless of temporary speculative flows.

Since you recognize the logic, we can relocate a step higher. While the copper market allows, the iron ore market is also bigger It’s the largest asset market among metals. An example is far better than a thousand words.

Do you keep in mind when we were unfazed by silver’s rally in springtime 2023, when all the gold bugs were requiring $ 30 + prices to be just nearby? Well, we saw that copper and iron ore rates did not support that sight.

Nonetheless, markets can behave unexpectedly. The current rally in metals is a prime example, with both silver and copper leading iron ore. Understanding the drivers that actually move the market is valuable. Observing cross-market partnerships beyond simply metals can be valuable hereof, which is something we focus on heavily in our premium study.

Keeping the above caveat in mind, I would certainly still say that bigger markets like iron ore normally dominate, considered that smaller markets like silver are a lot more vulnerable to being pressed by speculators. For that reason, the recent underperformance of iron ore need to make you attentive.

Understanding right into the physical market

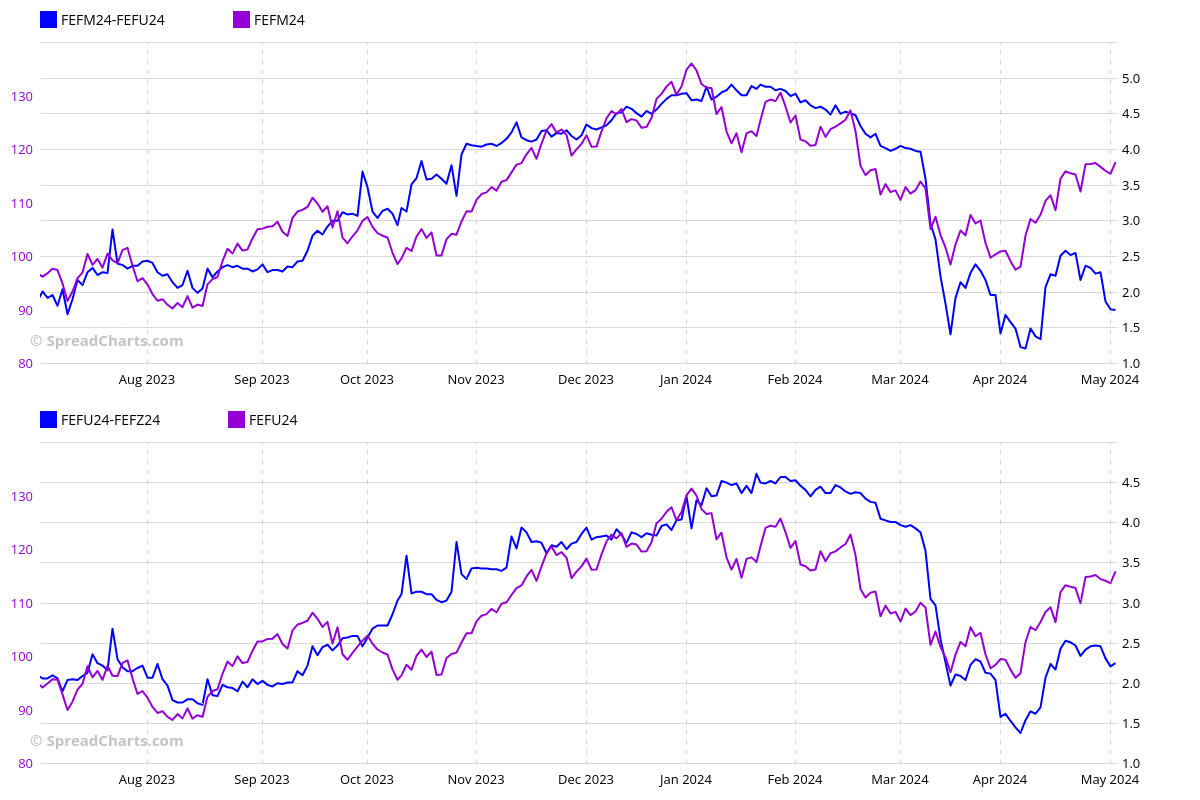

While cross-market analysis is valuable, the interdelivery spreads supply also deeper insight into the market. We enjoy them on a daily basis as they are most likely the most important piece of short-term information available. These spreads are less vulnerable to wide market manipulation and better mirror the actual conditions in the physical market. We utilize them as verification of the pattern we see in the underlying asset.

Of course, the best opportunities emerge when there is a aberration in between the spreads (blue) and the underlying (purple) If the divergence is sustained over a time period, the spreads are generally right, and the underlying commodity captures up. While these are temporary sensations only and do not function 100 % of the moment (like nothing in markets), it supplies an amazing edge in product trading.

If you’re familiar with our costs research study, you understand that we very closely view the copper and platinum spreads. Currently you can comply with the iron ore spreads out as well as an added piece of exceptionally beneficial data. The full contract specs for iron ore are listed below.

We had the ability to authorize the license with the SGX and add this new information into the application just thanks to our premium clients. If you want to see added information in the application, consider acquiring the premium membership

|

|

|

| Contract name | SGX TSI Iron Ore CFR China (62 % Fe Fines) |

|

|

|

| Exchange | SGX |

|

|

|

| Ticker | FEF |

|

|

|

| Expiration months | F, G, H, J, K, M, N, Q, U, V, X, Z |

|

|

|

| Money | USD |

|

|

|

| Agreement size | 100 statistics tonnes |

|

|

|

| Point value | $ 100 |

|

|

|

| Tick dimension/ value | 0. 05/ $ 5 |

|

|

|

| Negotiation | Financial |

|

|

|